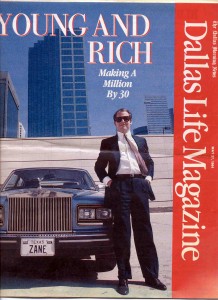

Young and Rich

DALLAS LIFE MAGAZINE – MAY 1984

Making a Million by 30

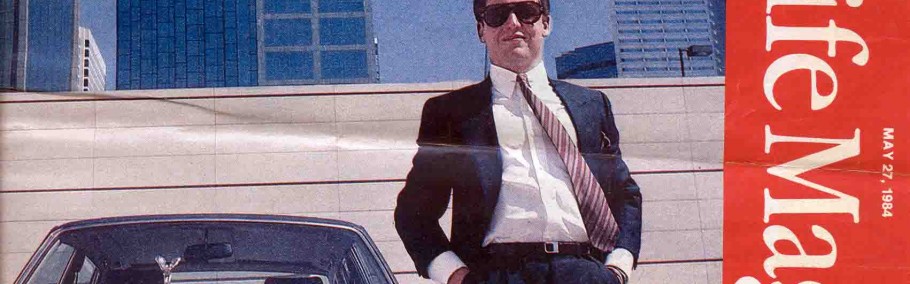

Paul Zane Pilzer’s downtown offices are all glass and steel, creamy white sofas, new computers, and the 30-year-old’s energy. “Meet me at 7:30 at The Palm!” he shouts into a telephone that seems to jangle constantly. He rides to meetings in a new Rolls-Royce or his Checker cab. His suits are Valentino; his house is new and sprawling. His is the classic rags-to-riches, modern-day Horatio Alger story.

The nice Brooklyn boy, son of European immigrants, was determined to make good. “If you saw Yentl, you saw the type of town my father grew up in,” Pilzer says. In high school, he learned the golden rule: it’s tough not to have money. So he built his success on the fear of not having any. “I believe there are two types of people: greedy people who have a lust for funds, and, one level above that, people who fear not having money,” he says. “You’re motivated by your insecurities. I associated in school with people from higher economic levels, but had tremendous insecurities about my parents being poor, about not going to Harvard.”

Instead of an Ivy League School, Pilzer went to Lehigh University in Bethlehem, Pa., earning a bachelor’s degree in journalism. Then he went on to earn an MBA from the Wharton Graduate School at the University of Pennsylvania–and to be rescued from the ranks of the uncouth by his roommate, who literally jerked the polyester suit off Pilzer’s back. “My roommate dragged me down to Brooks Brothers, bought me a wool suit, and said, ‘Please promise me that, whatever you do, you’ll wear this suit to any job interviews.'”

The suit, his Wharton degree and Pilzer’s natural chutzpah served the graduate well. He landed a job at New York’s Citibank and within a year was working as a lobbyist in Washington, pushing for passage of NOW (interest-bearing checking) legislation. On the side, Pilzer and an older brother were buying and renting large summer houses in the Hamptons. Pilzer also helped run the brother’s home furnishing sales and manufacturing firm, and at 23, he was making a couple hundred thousand dollars on top of his annual Citibank salary. “At 24, I had a house, a tennis court, a swimming pool and two mansions in the Hamptons that I’d rent out to friends for $4,000 per bedroom for the season.”

When the NOW legislation passed, Pilzer was transferred to the bank’s real estate division and put in charge of the equity real estate investments in the Southwest. The job involved trips to Dallas, putting large deals together with some of the city’s premier investors. “I’m proud to say that I’ve walked the dirt on almost every new project that has been built here,” says Pilzer.

In early 1981, one of America’s wealthiest men, whom Pilzer would rather not identify, walked into Pilzer’s New York office. “He said, ‘You’re through f—— me,'” Pilzer remembers. The gentleman had been beat out of several investment deals by Pilzer and Citibank, and wanted the young hotshot to help him invest $100 million in real estate in six months. The time limit was crucial: If he didn’t invest the money, the IRS would grab it. During a dinner at the Four Seasons, the investor pulled out his checkbook and told Pilzer to fill in an amount.

“We worked out a deal where I would receive a percentage for the profits I made him,” Pilzer says. “And he gave me a substantial deposit. I hired some of my staff from Citibank to help me. And one of the guys I hired said, ‘Let’s go to Texas.’ I flew to Dallas, checked into the Plaza of the Americas hotel and just lived there for a few weeks, doing deals. Finally, I said, “This is the place.'”

Dallas deals made both Pilzer and his investor a great deal of money. But after the $100 million was invested, Pilzer found himself without a job. He was 27 years old and worth considerably more than a million dollars. Then, Pilzer met Allan May, former chief operating officer of Steak and Ale. The two formed a partnership in a real estate syndication firm. Presently, the company serves as the general partner of several large real estate projects. In addition to his corporate duties, Pilzer is also an associate professor of finance at New York University, and he regularly speaks at real estate seminars and at a real estate institute he helped form.

Pilzer has established a five-year plan for himself that includes writing articles for business publications (putting his journalism to use), lobbying, teaching, and, of course, putting bigger and better deals together. For relaxation, he especially likes to dine at Jean Claude and New York’s Lutece, and he has an active social life. “I play extremely hard,” he says. Pilzer’s long-term goal? “Highest goal?” he asks. “Well, maybe, chairman of the Federal Reserve.”

“Right now, my biggest thrill is watching one of the young guys make money for the first time,” he says. “Because when I make money, nothing really changes my lifestyle. My biggest challenge is developing my writing career. I want to write nonfiction. Sometimes, I almost get scared when I think that I might run out of goals.”